The number of deals closed by venture capitalists in Europe has declined to its lowest point in seven years, according to KPMG. The reason: how could it be otherwise, the Covid-19 crisis.

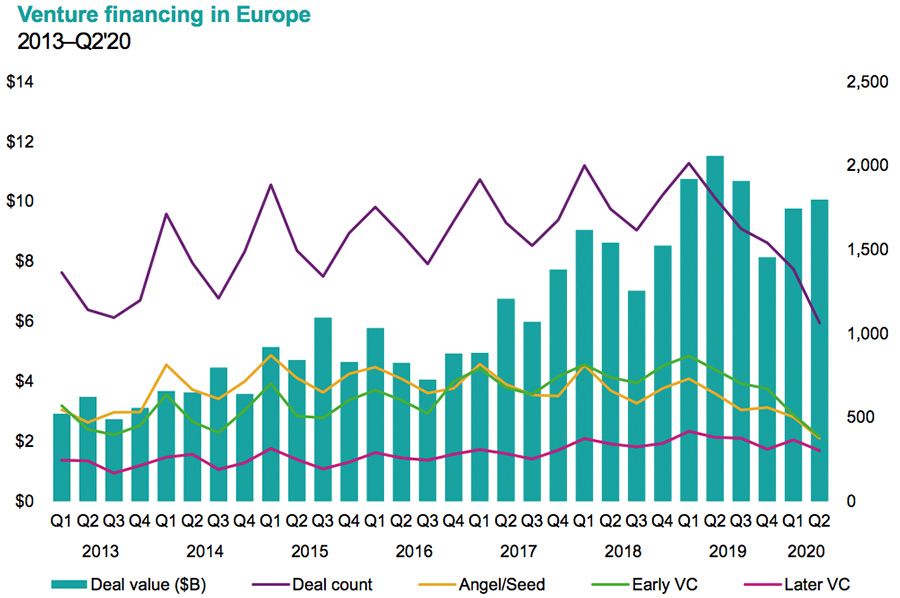

Around 2,000 European start-ups received funding from venture capitalists in the first quarter of 2019. Since then, the number of deals has fallen every quarter, but since the start of the Covid-19 crisis, deal activity nosedived. A development which is in line with broader trends in the M&A market, with has seen deal appetite of both strategic buyers and private equity firms drop strongly since March.

In the second quarter of 2020, just over 1,000 deals were closed. Europe is however not alone in its downwards spiral, in the United States for example – the largest venture capital market in the world – the number of transactions plummeted to a 7-year low. Globally, the number of transactions in the first six months of this year fell from 13,404 to 10,126.

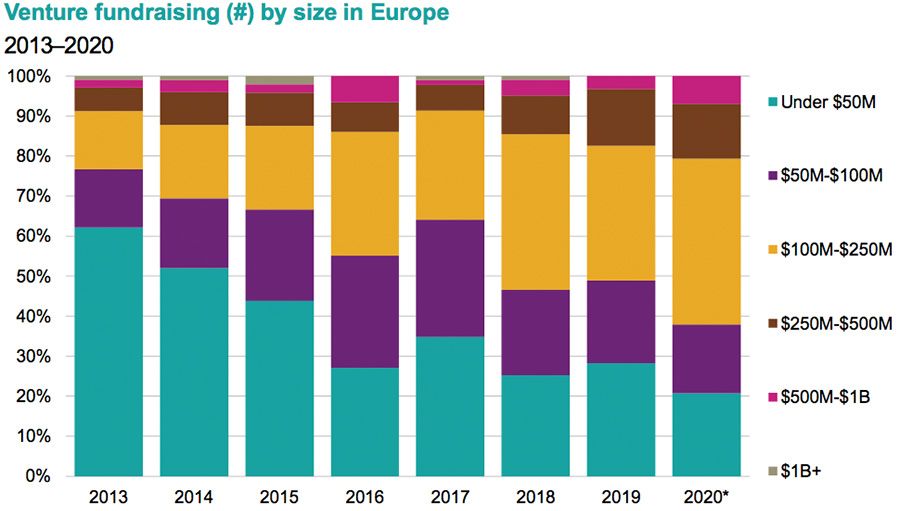

However, deal volume paints just part of the picture. The other side of the equation, deal value, has shown remarkable resilience since the outbreak of the pandemic. In the first six months of this year $19.9 billion was invested in European start-ups, $1.1 billion more than in the same period in 2019.

The most notable investments in Europe were the funding rounds pumped in Britain’s Deliveroo ($575 million), Germany’s N26 ($570 million) and Lilium ($270 million).

Start-ups that are active in the fields of healthtech, biotech and fintech and companies that offer B2B solutions will remain hot targets in the coming period. “Also start-ups focused on cybersecurity and data & analytics can also expect to be in-demand, against the backdrop of the rapid increase in remote working amid the corona crisis,” said Mark Zuidema, a partner at KPMG Corporate Finance.

The revival in deal value does mean that Europe managed to buck the global trend. Worldwide, deal value also dropped, by $9 billion to almost $127 billion.

Looking ahead, Zuidema expects that venture capitalists will maintain their cautious behaviour. “Investors will take more time for potential transactions, especially when conducting due diligence investigations. This will obviously impact the number of deals and the overall level of investments.”

Start-ups in sectors that are facing rapid change as a result of the Covid-19 crisis will have the best papers to attract the interest from investors. “Player specialised in online food delivery, for example, but also e-commerce, contactless payments and digital payments are expected to be in-demand.”

From an investor’s perspective, the crisis has one positive side. Prior to Covid-19, valuations had risen to record heights, but now this trend has ended abruptly. “There is pressure on the valuation of companies. This offers opportunistic investors the possibility to look for better value-for-money deals.”

Original article available on Consultancy.eu: https://www.consultancy.eu/news/4686/venture-capital-investments-in-european-start-ups-nosedives